Contents

For individual service providers and sole proprietorships, the net free foreign exchange earnings should be over US$ 10,000 a year. Announced in March, 2019, RoSCTL was offered for embedded state and central duties and taxes that are not refunded through Goods and Services Tax . Under it, incentives are given by the Ministry of Commerce and Industry to Service Exporters based in India to promote the export of services from India. Benefits would help merchandise sectors to maintain cash flows and meet export demand in the international market, which is recovering fast this financial year.

The Export Credit Guarantee Corporation of India introduced the NIRVIK scheme, which provides high insurance cover, reduced premium for small exporters and a simplified claim settlement process. RoSCTL scheme is only applicable to the apparel and made-up industry, covering Chapters of the ITC . It grants refund on taxes such as VAT on transportation fuel, captive power, ‘mandi’ tax and electricity duty. This scheme will be soon merged with the RoDTEP scheme in all sectors. Through the introduction of the digital platform, the clearance happens at a much faster rate.

The Merchandise Exports from India Scheme scheme seeks to promote export of notified goods manufactured or produced in India to notified countries. Export promotion has always been one of the top priorities for the Government of India. Several export promotion programs have been introduced from time to time with a special focus on the Indian MSME sector.

Furthermore, in January 2019, the scheme was extended to merchant exporters. The EPCG Scheme permits imports of capital goods for pre-production, production and post-production at zero customs duty. Capital goods imported under EPCG Authorisation for physical exports are also exempt from IGST and Compensation Cess upto March 31, 2020. Duty is leviable thereon under the sub-section and sub-section respectively, of section 3 of the Customs Tariff Act, 1975 , as provided in the notification issued by Department of Revenue. The scrips can be used to pay basic customs duty, safeguard duty, transitional product specific safeguard duty and anti-dumping duty.

- Hence for better export pricing and to remain competitive in the global market it becomes extremely important to have complete knowledge about all the export promotion schemes/export benefits in India and make full use of them.

- Under Duty Drawback Scheme , exporters are given compensation on customs and central excise duties incurred on materials used in the manufacture of exported goods.

- Each class further lists down the specific eligible services under the SEIS scheme.

- China’s success as an exporting nation lies in its manufacturers receiving a wide range of government incentives to produce almost exclusively for foreign markets.

This scheme allows certain waivers and concessions in compliance and taxation matters. The purpose of this scheme is the same as the Advance Authorisation Scheme, i.e., to allow duty-free imports of raw materials. However, this scheme is applicable post exports; this means that duty-free imports will only be allowed once exports are completed.

Types of Export Incentives Schemes & Benefits in India

Statutory compliances in the buyer Country – Maximum ceiling of Rs. 50 Lakh per annum per exporter on a 50-50% sharing basis. Statutory compliance includes Registration charges paid in the importing country in case of pharmaceuticals, biotechnology, chemicals/ agrochemicals, agricultural/ animal/marine products, food products, etc. The objective of this scheme is to play a catalytic role in promoting exports from India by exploring new markets and supporting all the export promotion activities in the new markets. For Example, to get one star export house status, export turnover to be achieved in current plus previous three financial years is USD 3 million.

It is a new scheme that is applicable with effect from January 1st, 2021, formed to replace the existing MEIS . The scheme will ensure that the exporters receive the refunds on the embedded taxes and duties previously non-recoverable. The scheme was brought about with the intention to boost exports which were relatively poor in volume previously. In the DBK scheme, duties of customs & central excise that are chargeable on imported and indigenous materials used https://1investing.in/ in the manufacture of exported goods are refunded back. Under the Export Oriented Unit , Electronics Hardware Technology Park , Software Technology Park and Bio-Technology Park schemes, enterprises aiming to export 100% of their inventory may be set up. These units will enjoy certain tax and compliance waivers and concessions, including duty-free import or domestic procurement of goods required for their operations and for setting up a central facility.

Furthermore, most export incentives are designed to ensure that the exporter receives subsidies, penalties, and other benefits as quickly as possible. This scheme endorses the import of duty-free inputs which would be physically integrated into the export product. This scheme is applicable for agricultural exports and came into effect in 2019. Under the TMA scheme, freight costs up of to a certain amount will be reimbursed by the government to make Indian agricultural products competitive in the global space. Finding out the rate of assistance for components, spare parts or ancillary items of the main product exported can be a problem.

INDIA’S TRADE POLICY

When approaching an organization like an Export Promotion Council, licensing authorities or the Drawback Directorate for a product classification, the exporter must present the details required to establish this classification. These include the technical and trade name of the product, its various uses and its essentials ingredients (raw materials, etc.). In addition to above, there are other schemes for promotion of products to international markets. Following illustration can actually help you to understand that on comparing customs duty applicable on imports from competitor countries, India has straightway extra margin of around 4.5% than Chinese exporter.

However, it comes with a condition that the exporter must have a turnover in preceding FY below 30 Cr and he should be a member of EPC for at least one year in order to apply for this benefit. The Objective of these benefits is to provide a level-playing field to the domestic manufacturers in certain specified situations, as may be decided by the Government from time to time. IGST Refund– Exporters can export goods “on payment of GST” and claim the refund of the same from the Customs Department.

Cummins India Ltd. v. DCIT 101 taxmann.com 325 (Pune – Trib.) – It was held that export incentives were to be considered as operating income while benchmarking international transactions of assessee. To be eligible in india export incentives are calculated on which price to avail the benefits of this scheme, the exported products need to have the country of origin as India. Manufacturer exporters and merchant exporters are both eligible for the benefits of this scheme.

GST Refund for Exporters / LUT Bond facility / 0.1% GST benefit for Merchant Exporters.

The DFIA Scheme also offers other advantages, such as access to new technologies, increased sales volume, improved product quality, and higher profits in the long term. The rebate will have to be claimed as a percentage of the Freight On Board value of exports. In addition, Following person can also availed benefits under Advance Authorization Scheme (‘AA’). Merchandise Exports from India Scheme is an export promotion scheme introduced by the Government of India.

It gives exporters a rebate of all taxes and levies paid when making their exports. This helps reduce production costs, allowing companies to compete more effectively in international markets. The scheme also encourages modern technology and better-quality products, contributing to economic development.

EXPORT INCENTIVES AND SUBSIDIES – WHETHER OPERATING OR NON-OPERATING FOR PLI COMPUTATION

Under RoDTEP, all sectors, including the textiles sector, are covered, so as to ensure uniformity across all areas. Additionally, a dedicated committee will be set up to decide regarding the sequence of introduction of the scheme across the various sectors, what degree of benefit is to be extended to each sector, and such related matters. The US had challenged India’s key export subsidy schemes in the WTO , claiming them to harm the American workers.

Export Promotion Capital Goods Scheme facilitates the import of capital goods to India to improve the country’s production quality and competitiveness. Import of capital goods is allowed at the pre-production, production, and post-production stages at zero customs duty. These too are exempt from integrated goods and services tax and compensation cess.

Therefore, India needs to increase its export performance to grow quickly. Of Central Excise Rules 2002 provides clearance of excisable goods for exports without payment of central excise duty from the approved factory, warehouse, and other premises. The service provider needs to have an active IEC to claim a reward under SEIS. Foreign exchange remittances other than those earned for rendering of notified services would not be considered for entitlement. This could include categories like equity or debt participation, donations, receipts of repayment of loans etc. and any other inflow of foreign exchange, unrelated to rendering of service. Service provider should have minimum net free foreign exchange earnings of US$ 15,000 during the year of rendering service to be eligible for Duty Credit Scrip.

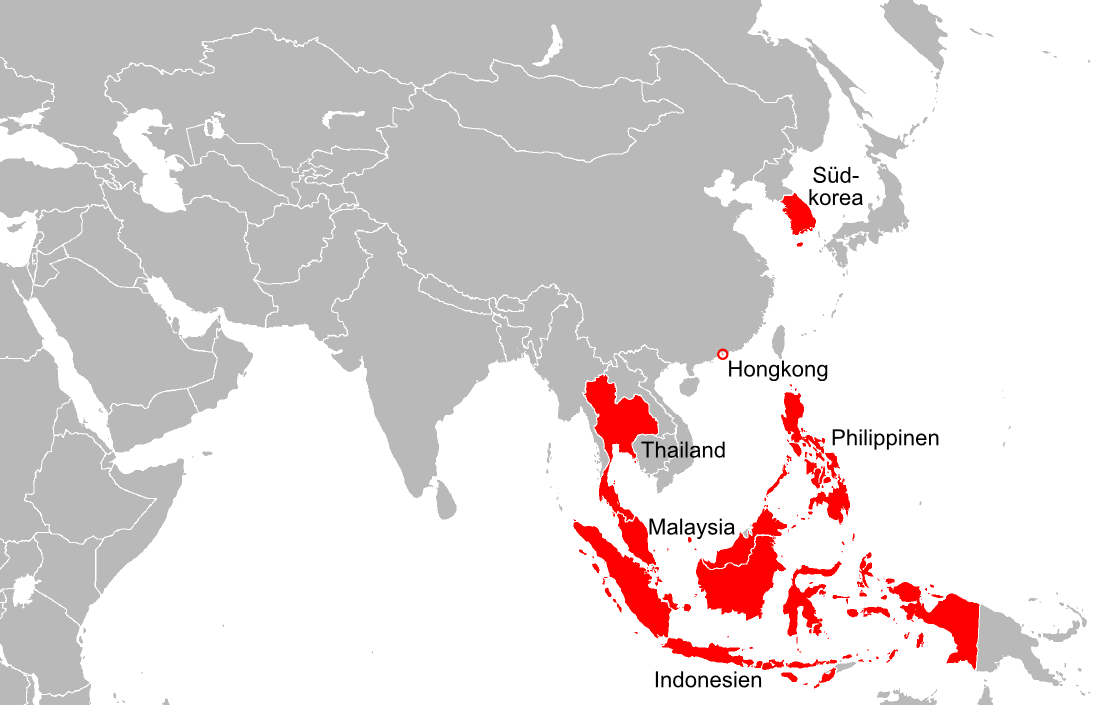

Image given provide the status category & export performance which needs to be maintained in last three and current financial year. The obligation is to export goods/services worth 6 times the duty saved value in a period of 6 years from the License issue date. The export of products notified/listed in Appendix 3B is only eligible for MEIS benefits. As you all know that Exports play a major role in the economic development of a country. More the exports more will be the inward foreign remittance, more jobs & employment, lower current account deficit, and hence greater overall economic growth.