Contents:

In addition, the dependence of the workers on language “brokers” to convey their grievances to management causes feelings of embarrassment, humiliation, and powerlessness. Providers’ costs include the commissions paid to annuity brokers and operating costs. In addition, general cargo vessels depend upon shipping agents and loading brokers to fill out their cargo space and to issue their bills of lading.

Export essentials: 10 steps to getting started in trade – Institute of Export & International Trade

Export essentials: 10 steps to getting started in trade.

Posted: Mon, 17 Apr 2023 11:00:37 GMT [source]

For this reason, a broker must be specialized and knowledgeable in the area he or she intends to work in. The training, therefore, comes in handy.It equips the broker with appropriate knowledge and skills to be able to execute his or her duties efficiently. Note that brokers exist not just in financial markets but also in real estate markets. When it comes to brokerage firms, they are required to operate under certain regulations. These regulations are usually based on the brokerage type as well as the jurisdiction in which the brokerage firm operates. Also, it is important to note that brokers do not get their license from the federal government.

Data Broker

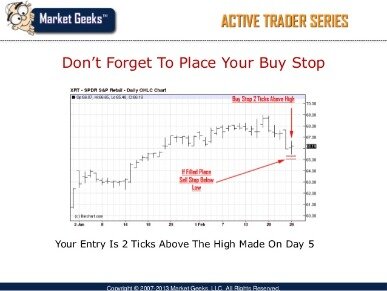

Forex brokers try to minimise their costs to stay competitive in the market, but you still pay certain fees when trading with them, including a spread. Transactions in the forex market are done in pairs, so you’d either buy or sell the pair you’d want to trade – for example GBP/USD. Online brokers use various brokerage websites to make business transactions. Their main job is to avail investment-related database information to their clients. The database information is presented in the form of charts, graphs, and investment tips. High-End brokers are mandated to study and make plans on the economys condition.

Under the rule, a broker-dealer must have possession or control of all fully-paid or excess margin securities held for the account of customers, and determine daily that it is in compliance with this requirement. The broker-dealer must also make periodic computations to determine how much money it is holding that is either customer money or obtained from the use of customer securities. This rule thus prevents a broker-dealer from using customer funds to finance its business.

British Dictionary definitions for broker

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Brokers who have a fee tail longer than one year after termination. We have seen instances where a broker will sign up a client and introduce the opportunity to hundreds of potential buyers with very little alignment and/or low probability of success.

The buyer can ask the broker pointed questions that might be difficult to ask you directly and get the answers he or she needs. The broker can also help answer any questions or resolve any problems that develop during the course of the sale. While it costs money to contract with a broker to sell your business, think of the commission you’d pay him or her as a kind of insurance. Intermediaries can choose to represent clients in selling and buying businesses. They are often paid by a success fee , which is based on a percentage of the sale price of the business. Business brokers help buyers and sellers of private companies in the trading process.

A business broker definition is an independent person or a company that organises and executes financial transactions on behalf of another party. They can do this across a number of different asset classes, including stocks, forex, real estate and insurance. A broker will normally charge a commission for the order to be executed. Business brokers who come from an outside region promising foreign buyers who will pay multiples much higher than what is currently offered in the market. This is often a tactic to sign sellers up for an exclusive engagement and collect significant upfront fixed fees for the preparation of an information memorandum or a “book”.

Instead, each state in the United States is in charge of giving their brokers license. Additionally, each state has its own laws which they use to define various correlations existing between investors and brokers. It includes the brokers duties to clients as well as members of the public. Issuers generally are not “brokers” because they sell securities for their own accounts and not for the accounts of others. Moreover, issuers generally are not “dealers” because they do not buy and sell their securities for their own accounts as part of a regular business. Issuers whose activities go beyond selling their own securities, however, need to consider whether they would need to register as broker-dealers.

Special laws and rules often apply to dual agents, especially in negotiating price. Business brokers generally serve the lower market, also known as the Main Street market, where most transactions are outright purchases of businesses. Business brokers and M&A firms do overlap activities in the lower end of the M&A market. Business brokers are paid through commissions based on a percentage, typically upwards of 5 percent, of the sale price they secure for the company. Others, meanwhile, might prefer to trim down these costs, perhaps by hiring a broker to just handle the final negotiation phase. A brokerage firm acts as an intermediary who makes matches between buyers and sellers of stocks, bonds, and other financial assets.

Strategies European Restaurateurs Can Use to Build Loyalty and Attract Repeat Customers

A promotional plan is designed to get customers more acquainted with your product by offering special prices and discounts. The best food broker doesn’t concern themselves with cold-calling. The best food brokers have connections that they have naturally built up over the years. A Food Broker is given the complex assignment of selling your food product. They achieve this through negotiation in order to stock your product in any store that sells food, whether that be your local co-op or a popular convenience store. A license holder is required to notify the Commission not later than the 30th day after the final conviction or the entry of a plea of guilty or nolo contendere.

- A managing broker is licensed and handles the day-to-day operations of the brokerage.

- As such, subsidiaries and affiliates of thrifts that engage in broker-dealer activities are required to register as broker-dealers under the Act.

- I called my broker for advice about investing in the stock market.

- A broker will normally charge a commission for the order to be executed.

- Others charge a small retainer ranging from a few hundred pounds to a few thousand.

Also, banks that act as municipal securities dealers or as government securities brokers or dealers continue to be required to register under the Act. Brokers may also earn commission on transactions they do for clients personally. So, in the example above, if the broker was a broker-owner and also the listing agent, they would get to keep all of their 3% commission on the $200,000 house. Brokers can also earn non-commission earnings, such as charging agents a monthly fee for admin services regardless of their sales. Usually discount brokers ask for a small commission on each sale and purchase and some ask for annual fees, though this is less common.

Requirements to Obtain a License

Typically, buyers and sellers look for a real estate agent, build that relationship, and then use whichever broker holds the license of their chosen real estate professional. For most real estate transactions, the buyer or seller won’t see the broker at all and will only interact with their agent. That means that if you’re getting ready to sell or buy a house, either a broker or an agent will be legally qualified to assist you in the process. A real estate broker has expertise that can help people with real estate transactions, and like an agent, a broker can also assist with selling or buying real property. 3 Section 9 prohibits particular manipulative practices regarding securities registered on a national securities exchange. Section 10 is a broad “catch-all” provision that prohibits the use of “any manipulative or deceptive device or contrivance” in connection with the purchase or sale of any security.

This influences which products we write about and where and how the product appears on a page. He has covered financial topics as an editor for more than a decade. Before joining NerdWallet, he served as senior editorial manager of QuinStreet’s insurance sites and managing editor of Insure.com. In addition, he served as an online media manager for the University of Nevada, Reno.

By contrast, business brokers typically specialize in smaller, main street companies. These businesses are usually valued below $2 million and in many cases, are owned by individuals or families who work there full-time. Working with a food broker to promote your product can save you money.

The real meaning of Xi’s visit to Putin – Financial Times

The real meaning of Xi’s visit to Putin.

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

This requirement has been construed to impose a duty of inquiry on broker-dealers to obtain relevant information from customers relating to their financial situations and to keep such information current. SROs consider recommendations to be unsuitable when they are inconsistent with the customer’s investment objectives. Within 45 days of filing a completed application, the SEC will either grant registration or begin proceedings to determine whether it should deny registration. An SEC registration may be granted with the condition that SRO membership must be obtained. The SROs have independent membership application procedures and are not required to act within 45 days of the filing of a completed application.

A transaction broker represents neither party as an agent, but works to facilitate the transaction and deals with both parties on the same level of trust. In the UK, it is generally only business brokers specialised in the sale of accountancy practices who operate as transaction brokers. A transaction broker typically gets paid by both the buyer and the seller. Traditionally, the broker provides a conventional full-service, commission-based brokerage relationship under a signed agreement with a seller or “buyer representation” agreement with a buyer.

A business broker is an individual or company that assists mainly in the purchase and sale of small, main street businesses. Proprietary trading refers to a financial firm or bank that invests for direct market gain rather than earning commissions and fees by trading on the behalf of clients. Discount brokers execute trades on behalf of a client, but typically don’t provide investment advice.

Naturally, when receiving a bespoke https://trading-market.org/ like that of a full-service broker, the fees are usually higher, often around 1%-2% on the assets managed. So, the fees on a portfolio of £200,000 would cost around £2,000 to £4,000 annually. To understand what brokers do, it helps to have some quick background about the stock market. You can compare online brokers to find one that’s right for your needs.

A full-time serviceable broker can charge anything close to 2% of the total transaction money. On the other hand, the online broker charges comparatively less, which may be like $5 – $20 on a trade to trade basis. Food brokers and distributors both build relationships with retailers and help in getting your product on shelves. Food distributors buy your product upfront, unlike food brokers who work on commission and resell it to retailers. If you have a niche food product, you need the help of a food broker who understands your specific market. Common areas food brokers specialize in are food service, grocery retail, bakery, and deli.

- A business that faces unique risks and challenges in finding coverage might be better served by an insurance broker.

- For example, stockbrokers licensed as financial advisers will often charge their clients fees for helping them decide which stocks to trade.

- This week showed us that even things that seem to last forever must come to an end.

Monthly account statements showing the market value of each penny stock held in the customer’s account. Broker-dealers, like other securities market participants, must comply with the general “antifraud” provisions of the federal securities laws. Broker-dealers must also comply with many requirements that are designed to maintain high industry standards. Form BDW is not considered “filed” unless it is deemed complete by the SEC and the SRO that reviews the filing.